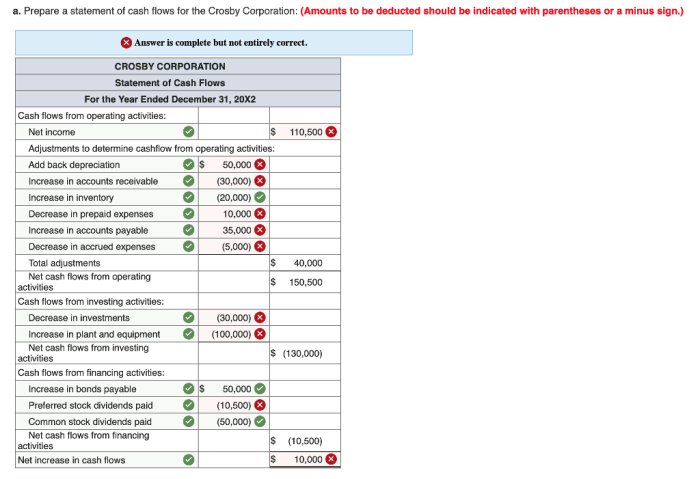

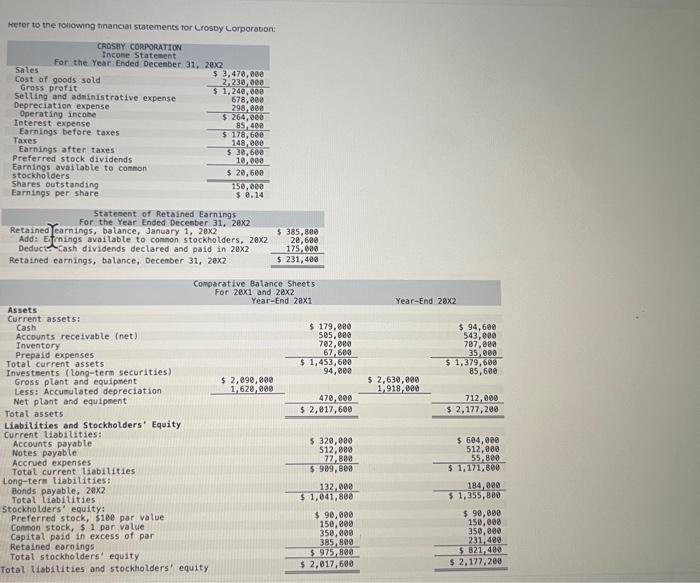

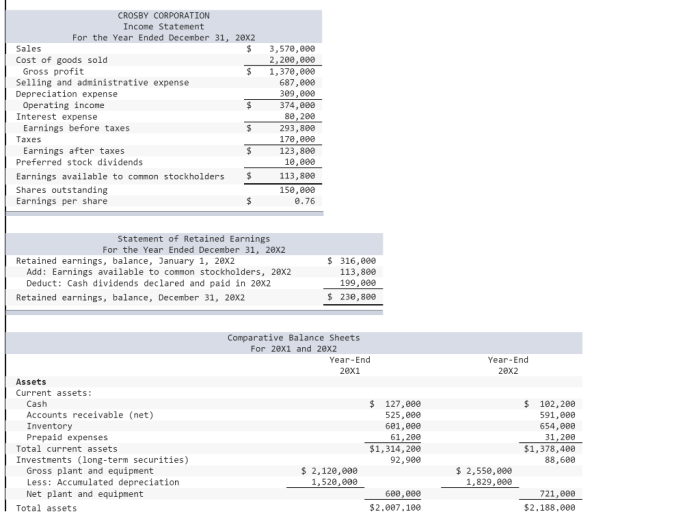

Prepare a statement of cash flows for the crosby corporation – Delving into the intricacies of financial analysis, we embark on a journey to explore the significance of preparing a statement of cash flows for the Crosby Corporation. This document serves as a crucial tool for understanding the financial health and performance of an organization, providing invaluable insights into its cash inflows and outflows.

The statement of cash flows offers a comprehensive overview of a company’s cash position, categorizing cash flows into three primary activities: operating, investing, and financing. By analyzing these cash flows, financial analysts and stakeholders can gain a deeper understanding of the company’s ability to generate cash, its investment strategies, and its financial stability.

Cash Flow Statement: Prepare A Statement Of Cash Flows For The Crosby Corporation

A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

It is important for financial analysis because it provides insights into a company’s liquidity, solvency, and overall financial health.

Cash flow statements can be used to:

- Assess a company’s ability to meet its short-term obligations

- Identify potential financial risks

- Make investment decisions

Types of Cash Flows

Cash flows are classified into three main categories:

Operating Activities

Cash flows from operating activities include cash generated from a company’s core business operations, such as sales, purchases, and expenses.

Investing Activities

Cash flows from investing activities include cash used to purchase or sell long-term assets, such as property, plant, and equipment.

Financing Activities

Cash flows from financing activities include cash raised or repaid through the issuance or repurchase of debt or equity.

Methods of Preparing Cash Flow Statement, Prepare a statement of cash flows for the crosby corporation

There are two main methods of preparing a cash flow statement:

Direct Method

The direct method reports cash flows directly from operating, investing, and financing activities.

Indirect Method

The indirect method starts with net income and adjusts it for non-cash items and changes in working capital to arrive at cash flow from operating activities. Cash flows from investing and financing activities are then reported separately.

Each method has its own advantages and disadvantages.

Analysis of Cash Flow Statement

Cash flow statements can be analyzed using various techniques:

Horizontal Analysis

Horizontal analysis compares cash flows over time to identify trends and patterns.

Vertical Analysis

Vertical analysis expresses each cash flow item as a percentage of total cash flow to identify the relative importance of different activities.

Common-Size Analysis

Common-size analysis expresses each cash flow item as a percentage of sales or another relevant metric to compare companies of different sizes.

Essential Questionnaire

What is the purpose of a statement of cash flows?

A statement of cash flows provides a comprehensive overview of a company’s cash inflows and outflows, categorizing them into operating, investing, and financing activities.

What are the different methods used to prepare a statement of cash flows?

There are two primary methods used to prepare a statement of cash flows: the direct method and the indirect method.

What are the advantages of analyzing a statement of cash flows?

Analyzing a statement of cash flows provides valuable insights into a company’s financial health, cash flow generation capabilities, and investment strategies.