A monthly paycheck best represents a – A monthly paycheck stands as the quintessential embodiment of financial stability and economic vitality, representing a predictable income stream that underpins personal and societal well-being. This article delves into the multifaceted significance of a monthly paycheck, exploring its role as a primary income source, a cornerstone of financial planning, a defining aspect of the employer-employee relationship, and a crucial economic indicator.

Income Source

A monthly paycheck is a primary source of income for many individuals, representing regular compensation for work performed during a specific period.

Unlike other forms of income, such as self-employment or investments, a paycheck is typically received from an employer and represents a fixed amount based on the employee’s agreed-upon salary or hourly wage.

Key Features of a Paycheck

- Regularly scheduled payments (e.g., monthly, bi-weekly)

- Fixed amount based on salary or hourly wage

- Deductions for taxes, insurance, and other benefits

- Itemized statement detailing earnings, deductions, and net pay

Stability and Predictability

A monthly paycheck offers a consistent and predictable source of income, providing financial stability and security. Unlike irregular or seasonal income sources, individuals receiving a regular paycheck can rely on a steady flow of income, allowing them to plan their expenses and savings effectively.

Regular Income

With a regular paycheck, individuals can anticipate their income each month, making it easier to manage their finances. They can establish a budget, allocate funds for essential expenses, and plan for future savings or investments. The stability of a regular income provides peace of mind and reduces financial stress, allowing individuals to focus on other aspects of their lives.

Financial Security

The predictability of a monthly paycheck enhances financial security. Individuals can confidently make financial commitments, such as rent or mortgage payments, car loans, and other obligations. They can also build an emergency fund to cover unexpected expenses, providing a safety net in case of unforeseen circumstances.

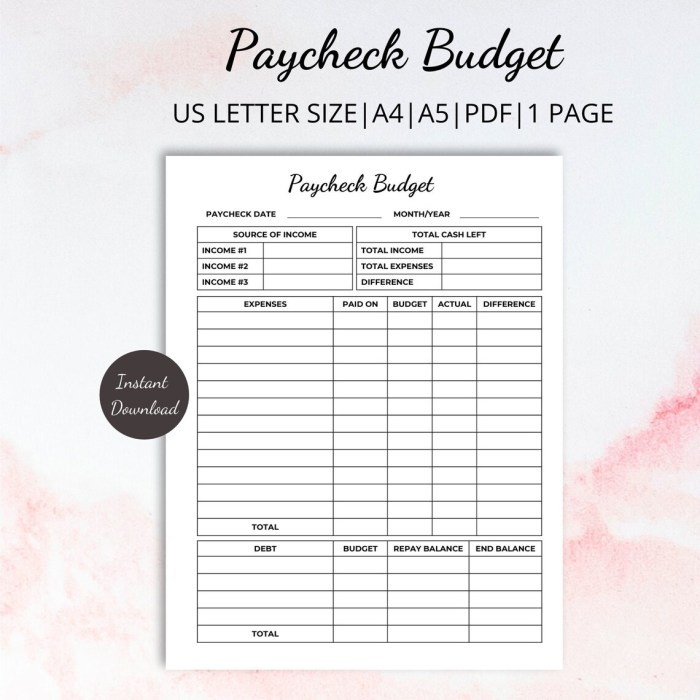

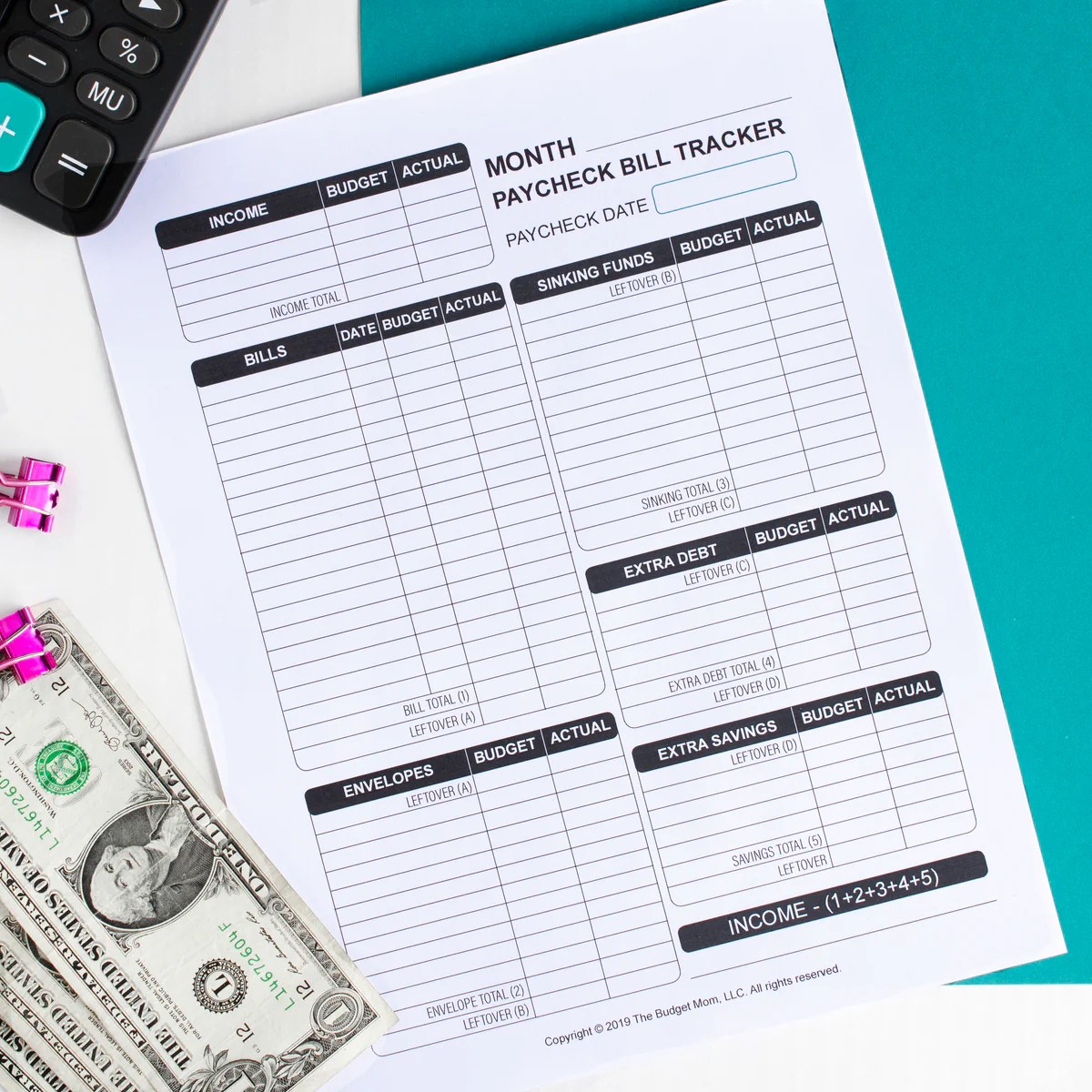

Budgeting and Financial Planning

A consistent monthly paycheck provides a stable and predictable income stream, which greatly simplifies budgeting and financial planning. This predictability enables individuals to forecast their income and expenses accurately, allowing them to create realistic budgets that align with their financial goals.

Expense Management

With a regular paycheck, individuals can anticipate their income and plan their expenses accordingly. This helps them avoid overspending and accumulating unnecessary debt. A consistent income stream provides a sense of financial security, allowing individuals to manage their expenses effectively and make informed financial decisions.

Financial Goals

A predictable income stream also aids in setting and achieving financial goals. Individuals can allocate a portion of their monthly income towards savings, investments, or debt repayment. By having a regular paycheck, they can track their progress towards their financial goals and make necessary adjustments along the way.

Employer-Employee Relationship: A Monthly Paycheck Best Represents A

A monthly paycheck plays a pivotal role in shaping the employer-employee relationship. It serves as a tangible representation of the employment contract, outlining the employee’s compensation for their labor and the employer’s obligation to provide that compensation.

Regular paychecks contribute to job security by providing employees with a steady income stream, which is essential for meeting their financial obligations and maintaining a stable lifestyle. The predictability of receiving a paycheck at a specific time each month fosters a sense of trust and reliability between employers and employees.

Employee Loyalty

Consistent and timely paychecks foster employee loyalty by demonstrating the employer’s commitment to its workforce. When employees feel valued and financially secure, they are more likely to remain with the company, reducing turnover costs and promoting a positive work environment.

In summary, monthly paychecks are not only a means of compensation but also a fundamental aspect of the employer-employee relationship, contributing to job security, employee loyalty, and a mutually beneficial working arrangement.

Economic Indicators

Monthly paychecks serve as significant economic indicators, providing valuable insights into the overall health and stability of the economy. They reflect the flow of income within the population and can influence consumer spending, inflation, and economic growth.

Payroll data, which includes information on the number of employees and their wages, offers a comprehensive snapshot of the labor market. It helps policymakers and economists gauge employment trends, labor market conditions, and the distribution of income. This data is crucial for understanding the overall health of the economy and making informed decisions about fiscal and monetary policies.

Consumer Spending, A monthly paycheck best represents a

Monthly paychecks directly impact consumer spending, which accounts for a significant portion of economic activity. When individuals receive their paychecks, they have more disposable income to spend on goods and services, contributing to economic growth and job creation. Conversely, a decline in paychecks can lead to reduced consumer spending, potentially slowing down the economy.

Inflation

Paycheck data also plays a role in understanding inflation, the rate at which prices for goods and services increase over time. If wages rise faster than productivity, it can lead to inflationary pressures as businesses pass on increased labor costs to consumers in the form of higher prices.

Overall Economic Health

The stability and predictability of monthly paychecks are crucial for overall economic health. Consistent and timely paychecks foster confidence among consumers and businesses, encouraging investment and economic growth. Conversely, uncertainty or delays in paycheck distribution can create economic instability and dampen consumer sentiment.

Question Bank

What are the key benefits of a monthly paycheck?

A monthly paycheck provides stability, predictability, and simplifies budgeting and financial planning.

How does a monthly paycheck contribute to economic health?

Payroll data from monthly paychecks serves as a valuable economic indicator, providing insights into consumer spending, inflation, and overall economic activity.